September 2018 Newsletter

Rent or Buy: Either Way You’re Paying A Mortgage!

By: Debbie Wysocki

Keeping Current Matters recently shared that there are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage.

The reality is unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s. As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

We know that home ownership is critical to creating wealth — and this is something my Dad taught me from an early age — it has also been shown that home ownership can account for an increase wealth by 44 times that of a renter. This statistic is according to the Top 100 Economists in the United States.

Need I say more?

“While renting on a temporary basis isn’t terrible, most people, when given the option would choose to own the roof over their head if they are truly serious about their finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

With home prices rising, many renters are concerned about their house-buying power. Mark Fleming, Chief Economist at First American, explained:

“Over the last three years, renter house-buying power has increased fast enough to keep pace with house price appreciation, so the share of homes that a renter can afford to buy has remained the same since 2015.

Although mortgage rates are expected to rise (and indeed have), they are still low by historic standards, and real household incomes are the highest they have ever been. Assuming this trend continues, our measure of affordability, which takes into account income, interest rates, and house prices, indicates that homeownership is still within reach for renters.”

Especially millennials who are the largest population in America at the moment (ages 20 -38 years old) and who have been somewhat hesitant to purchase their first home.

If they were following the same pattern as Gen Xers and Baby Boomers, we would see an increase in their home purchase pattern of 8 to 13 percent. Right now, it is taking a ‘life event’ such as marriage or a new child to trigger that home purchase. And, it is important to note – that there is considerable delay to both life events.

So, if you are indeed that millennial, ask yourself if you really want to wait to start growing your wealth? Owning a home is like a forced Savings Account!

I recently ran across a college student at the University of Florida where my son is currently enrolled as a Junior, and he purchased a 4 bedroom home with the help of his parents when he was a Freshman. He rents it out as a Vacation Rental to Parents and Alumni for — now that is a kid after my heart — he is more than covering his expenses . . . building equity . . . creating income (probably beer money), and will be able to springboard that home into another property when he leaves UF either after his Masters or when he goes to another school.

This is the power of Real Estate. I am guessing his parents must have taught him the power of owning a property.

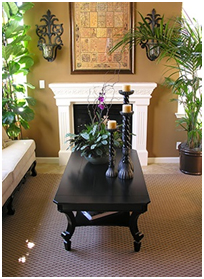

Houseplants: What to Consider

Looking to add a little lush life to your living space? Just like picking paint and furniture, it’s important to spend time choosing the best plants for your interior. Not only should you be considering the care your new plant friends will need, but also how they will impact your space as they grow to their full forms. Below are several tips for picking the best houseplants.